Gamestop and Cryptocurrency: How the online trading boom can be explained by Behavioral Economics

The share price developments of Gamestop and various cryptocurrencies have been receiving media attention for some while now. They highlight a change in the financial market, as trading has become more and more popular. Behavioural economics offers some approaches that help to understand what it is that makes trading so attractive.

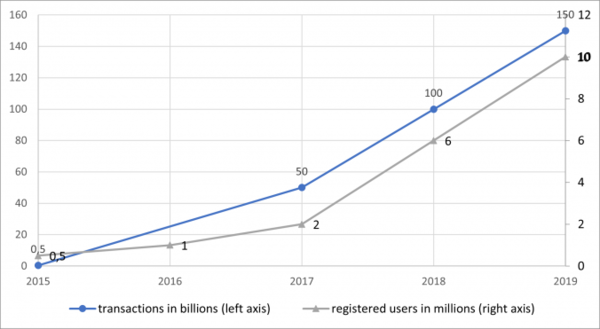

For several years now, a change has been sweeping through the world of Wall Street: once dominated by large investors, the number of small investors who invest using free online applications is rising steadily. A study by ‘The Modern Trader’ estimated that there were already 13.9 million online traders in 2018 – mostly men, aged between 25 and 34. This phenomenon is even more apparent in the cryptocurrency market – with 75% of online trader fitting this description. Taking a look at the data from Robinhood, one of the most popular free trading applications, it quickly becomes evident that the upward trend has remained unbroken for many years.

Figure 1: The Growth of Robinhood’s User Base and Transactions

Source: Business of Apps, 2020

The free trading applications make it possible for everyone to become a day trader. What no one seems to take into account in all the hype, however, is that, according to a study of the Brazilian market, 97% of day-traders lose money in the long run (Chague et al., 2020). Some years earlier a study of the Taiwanese market suggested that the share of day-traders making a negative profit in a six-month period lies at over 80% (Barber et al., 2003). Speculation on the financial market thus seems to be a relatively expensive hobby for small investors, but this does not seem to dampen the trend towards trading. Behavioral economics offers some approaches that can help us understand this development.

To understand the different dimensions which influence human behavior, the EAST structure can be applied. The structure was developed by the UK government’s Behavioral Insights Unit and is used as a quick tool to assess a new government initiative. According to the framework, an intervention should be Easy, Attractive, Social and Timely in order to have an impact on human behaviour. (Behavioural Insights Ltd, 2014).

- Easy:

Companies like Robinhood know a lot about the psychology of human behavior. Many of them employ their own behavioral economists to help design the application. As a result, modern trading applications reduce transaction costs and make trading exceptionally easy. The barriers to entry are low, with just a few clicks the account is created and the first transactions can be carried out. Ranging from bright colors for Bitcoin prices and playful animations for completed purchases, to the prominent placement of cryptocurrency prices on the home page, the design features create a sense of the gamification of trading. This motivates users to bet on individual stocks and cryptocurrencies, i.e. to carry out rather risky transactions, as Tara Falcone, certified financial planner, explains. (NBC News, 2019). The effect is the gamification of speculation, trading seems easy and playful and it can be carried out just a little too mindlessly.

- Attractive:

To make trading a desirable pastime, users must believe in their own success. However, while the statistics speak against the likelihood of individual success, some human biases cause traders to overestimate their personal chances. The so-called hindsight bias, for example, describes the phenomenon that individuals feel after an event that they have anticipated its outcome long in advance. This is especially true in the financial market. While the market sometimes seems arbitrary and volatile, many people tend to think that they have seen the current developments in advance. This misjudgment motivates further risky speculation. Another human bias is the so-called ‘availability bias’ The probability of success tends to be overestimated because success stories are generally remembered for a longer time and remain more salient – thus distorting the perceived probability of success. The stories of the many people who did not win anything and failed on Wall Street remain unknown and their existence is largely ignored by the human brain.

Behavioral economics also examines human hubris through the concept of overconfidence. Various studies have shown that people are relatively good at assessing the competitive situation, but systematically overestimate their own abilities and thus also their probability of success (Camerer/Lovallo, 1999). Overconfidence is more prevalent among men (Barber/Odean, 2001). In stock trading, this means that the average trader is aware of the low statistical probability of success and yet, he has an inflated sense of his own ability, believing that he can beat the market and recognize trends earlier. . Another psychological bias intensifies this overconfidence: the reference group neglect. This term describes the fact that most people do not adapt to changing competitive conditions – they forget that most traders also consider their skills to be above average and participate in trading precisely for that reason.

Hence, various human biases lead traders to systematically overestimate their abilities and therefore believe in their own gain – making trading attractive despite the unpromising statistics.

- Social:

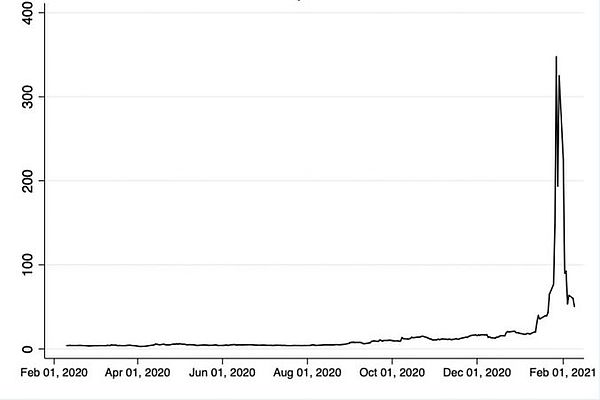

The recent developments around Gamestop also illustrate the social component of trading. The users met on the internet platform Reddit to jointly drive up the share price. They were successful with share prices rising from 18 to 400 dollars, as shown in the following graph.

Figure 2: Gamestop Share Price

Source: finance.yahoo.com

A feeling of social unity emerged. But those who are not involved have the feeling of missing out on the next big trend and are haunted by regret. The feeling is often referred to with the term FOMO, the „Fear of missing out“. In terms of behavioral economics, this feeling can be explained by loss aversion. People experience he pain of a loss twice as much as they enjoy comparable gains (Tom et al., 2007). The potential financial and social loss from a missed trend has a much more severe psychological impact on the human well-being than the occasional gains. The fear of such losses drives people to follow the social masses on the internet – a herd behavior emerges where the individual investor no longer takes his own expertise and intuition into account, but blindly trusts the influential voices of the internet. The human loss and risk aversion can also help to explain human greed in general. As evolutionary psychologists suggest, the pursuit of consumption and possession can be a rational strategy in an environment characterized by uncertainty and continuous changes in order to protect oneself from future losses.

- Timely

Another factor in the UK Behavioural Insight Unit’s EAST analysis is time. The timing factor of perceived cost and profit motivates human behaviour to a large extent. People are influenced by present bias which is the tendency to give greater weight to costs and profits that arise immediately than to those that arise in the long term. If one analyses the various investment alternatives, it becomes clear that the present bias leads to a preference for short-term, high-risk investment opportunities. For example, if a user invested in Gamestop shares in the last few days, he could immediately observe his profits – without perceiving the risk of long-term loss. If, on the other hand, a user follows a long-term investment strategy that reduces long-term risks through diversification, the gains cannot be observed immediately. At first, only the directly incurred costs are perceived, the money that was invested is no longer available. The feeling of not being able to make money at this very moment through a risky investment may also have the character of a direct cost. The present bias can therefore also motivate a short-term, riskier investment strategy.

The EAST analysis highlights several dimensions of online trading apps that can help explain the surge in trading. Human psychological biases motivate risky online trading to be perceived as particularly attractive and promising, and risks take a back seat. The trading apps undoubtedly have great potential – for example, they make the financial market accessible to more people and encourage them to think about their investments. However, the trading game can become dangerous if the user bets money that he cannot afford to lose.

If you are interested in how Behavioral Economics can help explain people’s everyday behavior you might also want to give this a read: Enste, Dominik H. / Kary, Johanna, 2021, Die sieben Todsünden. Verhaltensökonomische Interpretationen und Handlungsempfehlungen, IW-Analysen, Nr. 141, Köln. In this analysis, we examined the seven deadly sins using a behavioral approach. (only available in German)

__________________________________________________________________________________________

Dich interessieren mehr Inhalte wie diese?

Informiere dich jetzt über unseren berufsbegleitenden Masterstudiengang „Behavioral Ethics, Economics and Psychology“ an der IW Akademie:

Zum Master Behavioral Ethics, Economics and Psychology wechseln

___________________________________________________________________________________________

Sources:

Barber, B.M./ Odean, T., 2001, Boys will be Boys. Gender, Overconfidence and Common Stock Investment. in: Quarterly Journal of Economics, 116. Jg. Nr. 1, S.261-292

Barber, B. M./ Lee, Y. T./ Liu, Y. J./ Odean, T., 2004, Do individual day traders make money? Evidence from Taiwan. University of California, Berkeley, working paper.

Camerer, C./ Lovallo, D., 1999, Overconfidence and Excess Entry. An Experimental Approach, in: American Economic Review, 89. Jg., Nr.1, S.206-318

Chague, Fernando/ De-Losso, Rodrigo/ Giovannetti, Bruno, 2020, Day Trading for a Living? University of São Paulo (FEA-USP)

Service, O./ Hallsworth, M./ Halpern, D./ Algate, F./ Gallagher, R./ Nguyen, S./ Ruda, S./ Sanders, M., EAST Four simple ways to apply behavioral insights

Tom, S. M./ Fox, C. R./ Trepel, C./ Poldrack, R. A. ,2007, The neural basis of loss aversion in decision-making under risk. In: Science, 315(5811), 515-518.

David Curry, 2021, Robinhood Revenue and Statistics (2020) , https://www.businessofapps.com/data/robinhood-statistics/, (15.02.2021)

The modern Trader: A Report on the 13.9 Million Online Traders https://brokernotes.co/modern-trader/ (15.02.2021)

David Ingram, 2019, Designed to distract: Stock app Robinhood nudges users to take risks, https://www.nbcnews.com/tech/tech-news/confetti-push-notifications-stock-app-robinhood-nudges-investors-toward-risk-n1053071 (15.02.2021)

finance.yahoo.com (15.02.2021)